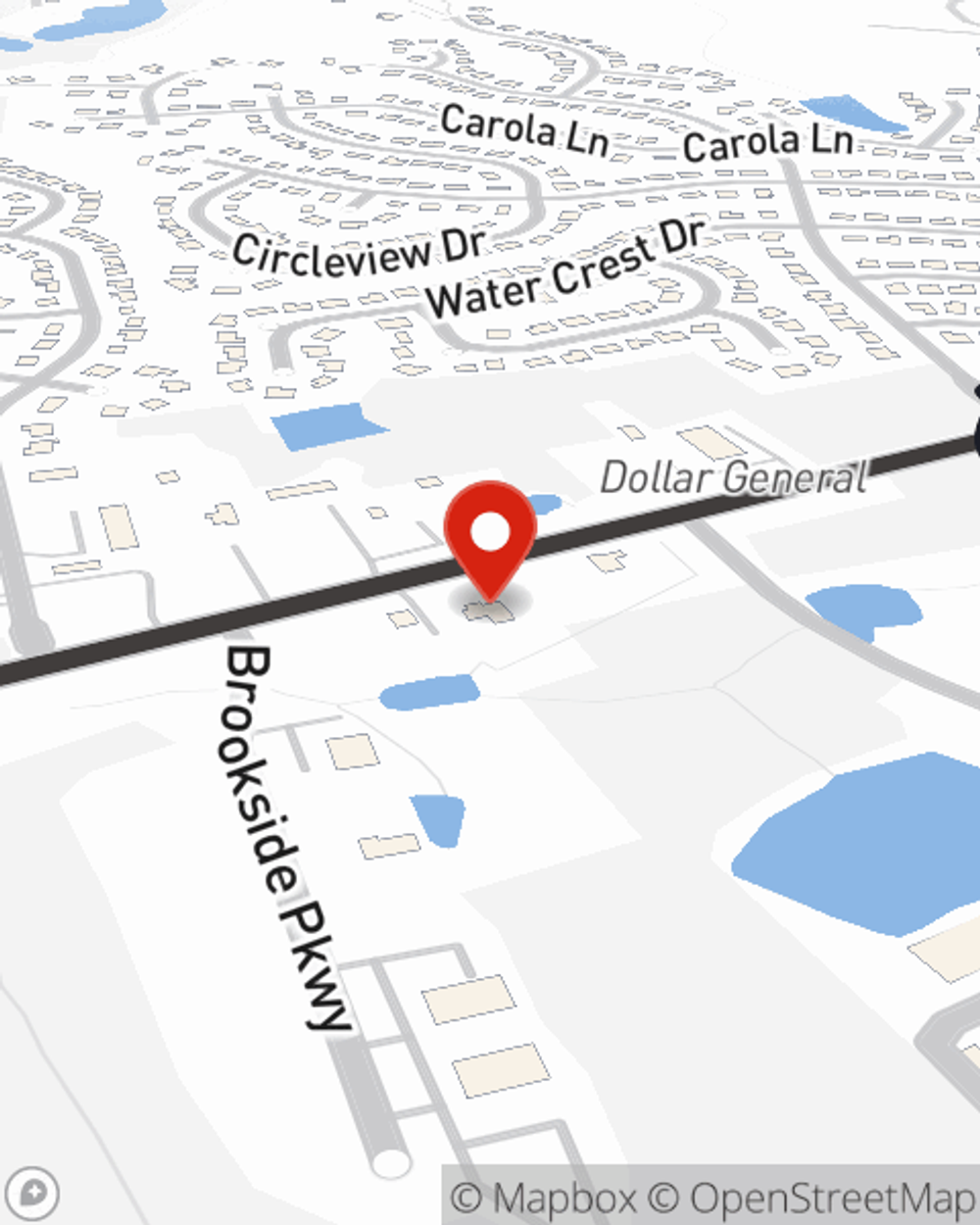

Life Insurance in and around Lexington

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- South Carolina

- Lexington

- West Columbia

- Irmo

- Columbia

- Chapin

- Greenville

- Charleston

- Aiken

- Spartanburg

- Florence

State Farm Offers Life Insurance Options, Too

People purchase life insurance for individual reasons, but the primary reason is usually the same: to ensure a certain financial future for the people you're closest to after you're gone.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Put Those Worries To Rest

But what coverage do you need, considering your situation and your loved ones? First, the type and amount of insurance you opt for will depend on your current and future needs. Then you can consider the cost of a policy, which is determined by your current age and how healthy you are. Other factors that may be considered include lifestyle and body weight. State Farm Agent Larry Hutto can walk you through all these options and can help you determine what will work for you.

To learn more about your Life insurance policy options, get in touch with Larry Hutto's office today!

Have More Questions About Life Insurance?

Call Larry at (803) 957-0707 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Larry Hutto

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.